If you have an EPFO account and want to EPF Withdrawal your money from it then you have to follow some steps which I will tell you step-by-step today. For this process, you need EPFO member passbook.

Steps for EPF Withdrawal Online

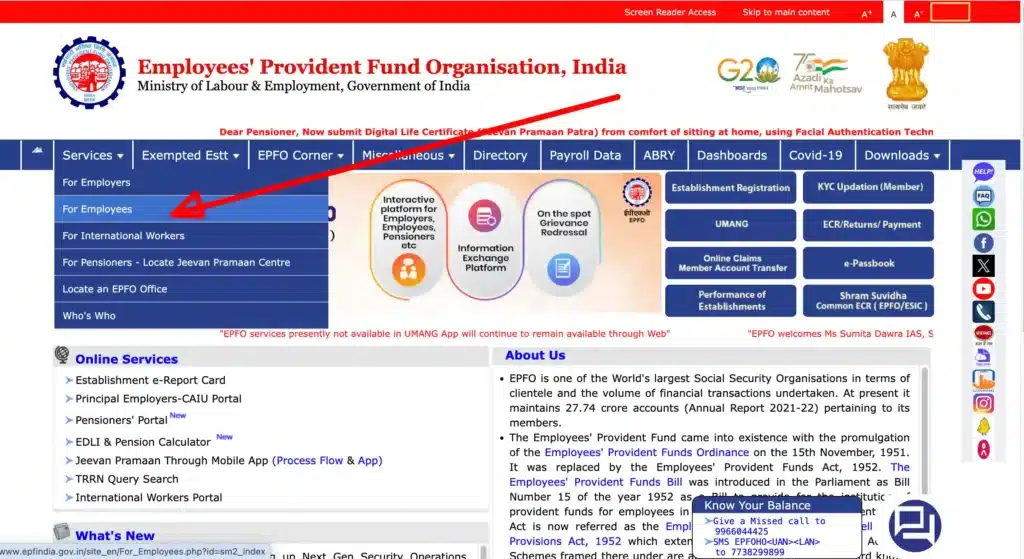

Step-1: First, Visit the official site of the EPFO member portal on your available device. https://www.epfindia.gov.in/site_en/index.php

Step-2: Then you will have to go to the << For Employees >> section and there you will get a << Our Services >> option. On it you have to click.

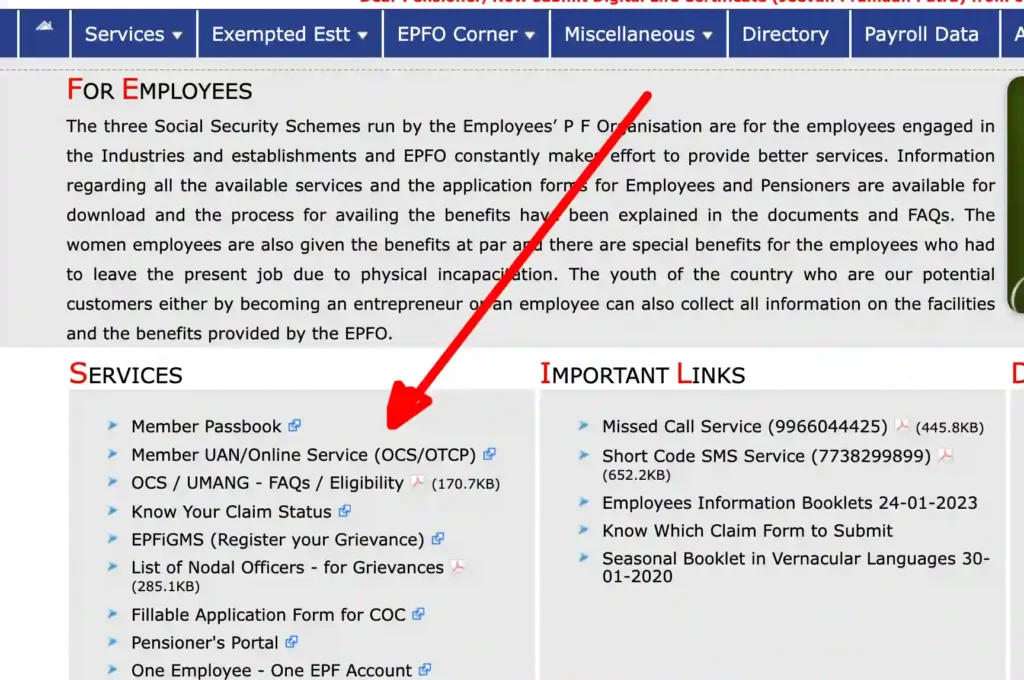

Step-3: Then a new page will be open on a new tab. There you have to find out << Member UAN/Online Service (OCS/OTCP) >> and click on it.

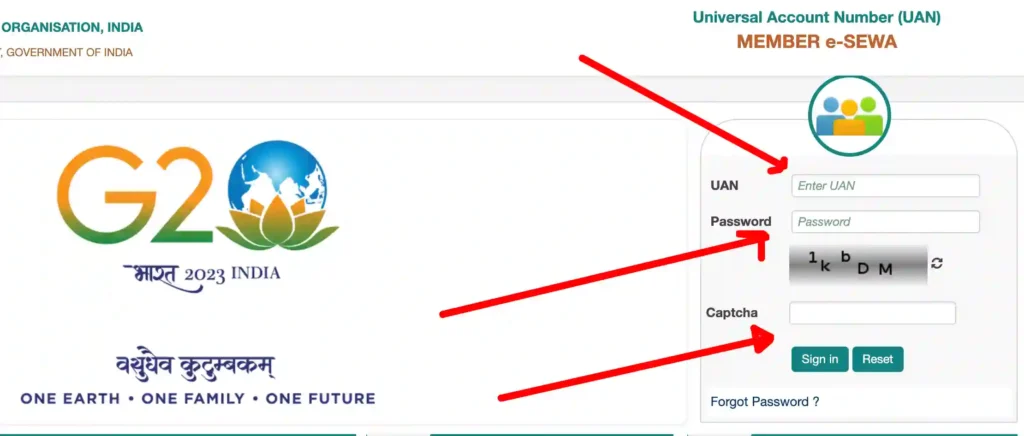

Step-4: Then a new page will open like this, There you can see the option of UAN, Password and Captcha code.

Step-5: Next Enter the right 12-digit UAN number and password and then click on the sign-in option.

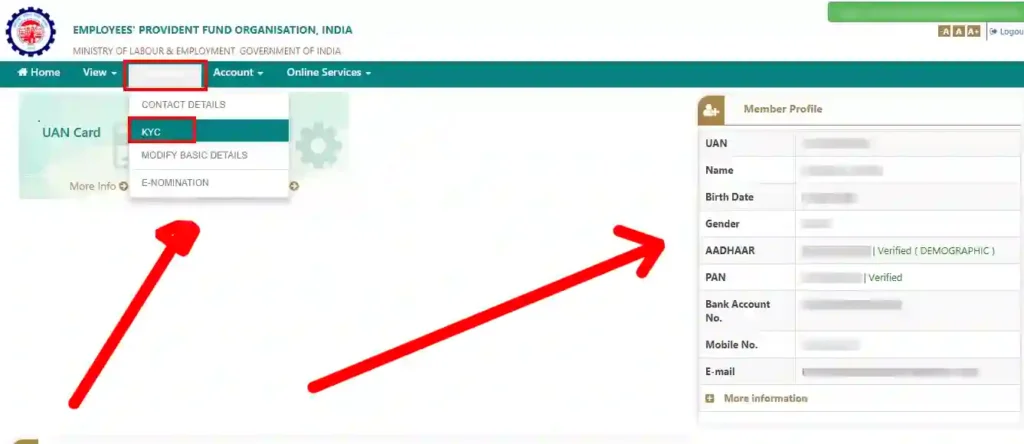

Step-6: On this page, you have to go to the << KYC >> option under the << Manage >> tab. Now you will reach to the new page look like this.

Step-7: Then there are you have to find out an option in the << Digitally Approved KYC >> section and then there you can get details of your KYC.

Step-8: then read this step carefully now that If all of your KYC information is correct, click the “Online Service” link in the top menu.

Step-9: Then there is a main step there you have to Select the “CLAIM (FORM-31, 19 & 10C)” option from the drop-down box.

Step-10: If you see there that You are transferred to a new page with an automatically generated “ONLINE CLAIM (FORM 31, 19 & 10C)” form.

Then you have to follow this step which is to Enter the last four digits of your registered bank account number and validate it.

Step-11: Then you have to verify your bank account here. For that you have to do a simple step which is there a “Certificate of Undertaking” will be generated. To proceed, click ‘Yes’ in the certificate pop-up. That’s it.

Step-12: Then you have to go and click on the “Proceed for Online Claim” option to proceed ahead.

Step-13: If you want to withdraw funds, select the “PF ADVANCE (FORM – 31)”

Then you will go to the next step “I want to apply for” option. And click there.

Step-14: A justification for a claim must be selected from the drop-down menu next to the “Purpose for which advance is required” option. The areas for the employee’s address and the amount of the advance must also be filled in.

Then you have to Click on the checkbox at the bottom of the page to submit your withdrawal application. Which is so an important step.

Step-15: And at the end once employer approves the withdrawal request then your Step so read here this step so carefully that is Once the employer confirms the withdrawal request, the amount will be removed from the EPF account and deposited in the designated bank account. When the claim is satisfied, you will receive an SMS notice to your registered telephone number.

New EPF Withdrawal Rules

- In contrast to a bank account, money in an EPF account can only be withdrawn after retirement.

- Partial withdrawal can be requested online and is appropriate for emergencies such as medical treatment, higher education, the acquisition of a residential home, or building.

- EPFO enables a withdrawal of 90% of the EPF corpus one year before retirement, provided the person is at least 54 years old.

- The EPF corpus can be withdrawn if an employee becomes unemployed before retirement due to a lockdown or retrenchment.

- This scheme provides for the withdrawal of 75% of the corpus after one month of unemployment and the transfer of the remaining 25% to a new EPF account following new employment.

- And, If an employee contributes to the EPF account for five consecutive years, the withdrawal of the EPF corpus is tax deductible.

- TDS will be deducted on premature withdrawals from the EPF corpus, but not if the total amount is less than Rs.50,000.

- TDS deduction for premature withdrawal is 10% if PAN is submitted, and 30% + tax if not.

- EPF status can be checked online or directly through EPFO if the UAN and Aadhar are linked and approved by the employer.

- To withdraw the EPF sum, the EPF subscriber must first declare unemployed.

The prior guideline allowed for 100% EPF withdrawal after two months of unemployment.

Note: if you are unable to withdraw your amount then you need EPFO KYC update online.

FAQ

Can we withdraw EPFO pension contribution from EPF?

Yes, You can withdraw so easily.

Is EPFO withdrawal taxable?

Yes. It’s Taxable.